Financial technology is sprinting ahead, as if it’s late for its own IPO. From giving mobile banking wings in rural corners to whispering AI-powered lullabies to regulators, the fintech story is a whirlwind of access, ambition, and absolute chaos.

But what happens to the future of fintech when that chaos leaks into your login screen?

In June 2025, the world woke up to a shocking stat: 16 billion passwords leaked online – the largest such breach in internet history. Not from some deep hack into Apple, Google, or Facebook. No. This was not Ocean’s Eleven. It was more like your uncle’s malware-ridden laptop quietly stealing every login while playing Candy Crush.

This was not one company. It was all of them.

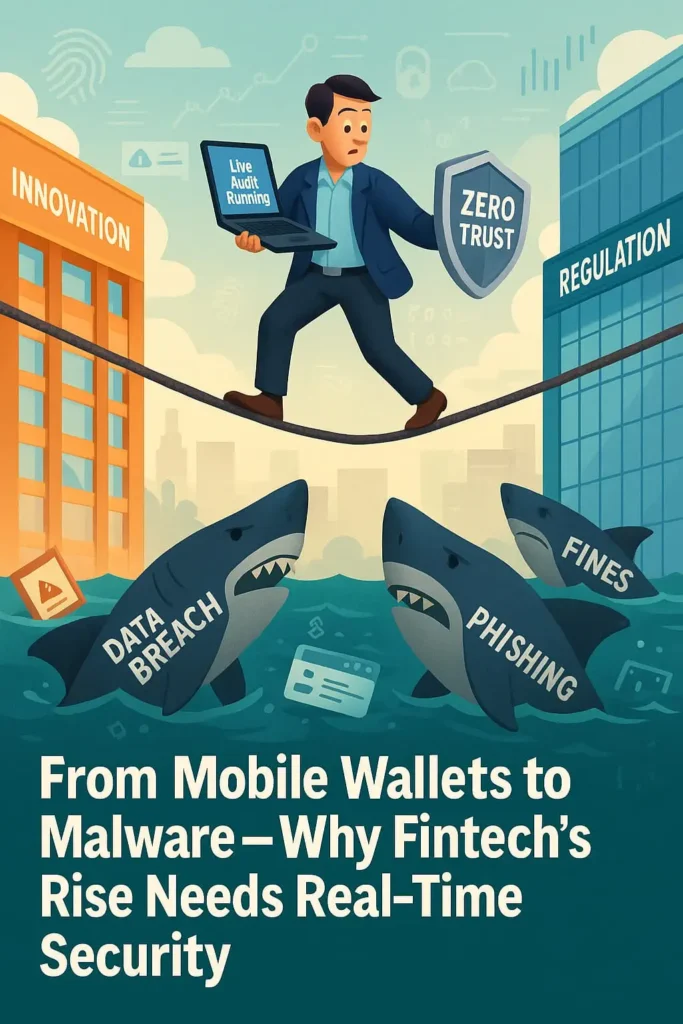

The leak did not just expose user data. It exposed fintech’s most dangerous myth: that we can move fast, break nothing, and somehow keep everything secure with a last-minute patch and a quarterly audit.

Today’s fintech is not just about enabling payments or onboarding SMBs. It’s about dodging deepfakes, detecting threats in real time, and making compliance sexy enough to run on autopilot.

So yes, fintech is still flying high. But some of us are starting to ask: did we remember to pack a parachute?

Let’s unpack the state of fintech security — The Peak View Stories style — minus the jargon but with all the juice.

Mobile Banking Is Now Reaching Where Even Pizza Can’t Be Delivered

First, let’s see how fintech’s reach is outpacing even pizza delivery apps — and why that’s both impressive and risky.

Once upon a time, banking meant standing in line behind someone arguing over ₹3. Now, with just a smartphone, you can send money, apply for loans, and manage savings — no bank branch (or branch manager chai break) needed.

This is especially powerful in regions where banking infrastructure is a fantasy. Digital wallets and mobile-first platforms are opening doors for the unbanked and underbanked — people who previously had to store savings in envelopes behind rice jars.

But here’s the twist: that digital door is wide open, and so are the windows — for hackers.

“API misconfigurations, poor authentication, and exposed endpoints are still common in fast-moving fintech environments,” warns Trevor Horwitz, CISO at TrustNet.

In short: while fintech helps the poor save money, sloppy APIs help cybercriminals steal it.

Speed vs Security: The Most Toxic Fintech Relationship

Fintech’s motto has always been: “Move fast and maybe break everything.” That includes breaking trust, data, and sometimes even laws.

“Pushing out new features without a solid security foundation creates gaps that attackers are quick to exploit,” says Trevor. “Security can’t be an afterthought.”

Translation: Stop treating cybersecurity like your Terms & Conditions — nobody reads it until it’s too late.

At Lessn, a startup helping SMBs make credit-based supplier payments (even when suppliers say “We don’t do cards”), David Grossman, Founder & Chief Growth Officer, Lessn, says the hustle is real:

“The biggest challenge is speed. We’ve had to be intentional about building innovation pipelines that include security checkpoints.”

Basically, speed is hot — but security is the long-term partner you ghost at your own risk.

AI Is Now Doing Security. But Please Supervise Your Robot

When security is too slow and hackers are too fast — maybe it’s time to call in the robots.

AI isn’t just writing cringe LinkedIn posts anymore. It’s also fighting cybercrime.

Agentic AI, a new generation of machine intelligence, can scan, detect, isolate, and even respond to threats in real time. Think Jarvis, but for fintech.

“These systems don’t just flag issues,” Trevor adds. “They can take remediation steps on their own.”

But before you let your AI babysit your infrastructure:

“They can make bad assumptions or miss context,” he warns. “Powerful tools, but they don’t replace human judgment. Not yet.”

So yes, Agentic AI is cool. Just don’t let it run the whole show while you’re off at a funding round party.

Fintech Fraud: New Features vs New Frauds

Even with all the firewalls and fail-safes, fintech remains a buffet for bad actors. Every new feature, if not sealed airtight, is a new menu item for hackers.

“Handling sensitive financial data means your attack surface expands fast,” says David Grossman. “We rely on smart monitoring and anomaly detection to flag issues before they blow up.”

AI-powered fraud detection is stepping in to read patterns and spot weird behavior. It’s like a bouncer that knows who’s drunk before they enter the bar.

For smaller businesses without security teams, this built-in protection isn’t a luxury — it’s the difference between staying online and going under.

Behavioral Biometrics: Because Hackers Don’t Swipe Like You

But beyond what you click, fintech is now watching how you click.

Fintechs are embracing behavioral biometrics — a fancy way of saying “your phone knows how you type.”

Your swipe speed, typing rhythm, even how you scroll memes — all of it adds up to a digital fingerprint. If someone else tries to act like you? The system knows. Creepy? Yes. Effective? Also yes.

“It detects suspicious activity without interrupting the user experience,” notes Abby Shemesh, Chief Acquisitions Officer at Amerinote Xchange.

So now, fintech isn’t just watching what you do — it’s watching how you do it.

Compliance is Now Real-Time. Say Goodbye to Lazy Quarterly Reports.

Still reading? Or just here for the headlines? Either way, here’s what you need to know.

Regulators are done playing nice. They want live dashboards, real-time alerts, and constant visibility — not PDF audit reports sent once a year like a late birthday card.

“Companies will need to build compliance into their infrastructure,” says David. “Not just treat it as an end-of-quarter task.”

Niclas Schlopsna of Spectup agrees:

“We’re already advising clients to prepare for tighter frameworks. It’s better to be ahead than scramble when the law catches up.”

This isn’t optional. It’s the fintech future. Build compliance into your DNA — or prepare to bleed out in legal red tape.

TL;DR: The Future of Fintech Is Fast, Smart, and Watched by Everyone

Here’s the state of things:

- Fintech is bringing banking to the unbanked — but must secure every digital gate it opens.

- Speed is sexy, but security is survival.

- AI is the bouncer, but you’re still the manager.

- Biometrics and anomaly detection are quietly working in the background — like good IT teams should.

- Regulators now want real-time compliance, not post-mortem excuses.

Fintech isn’t just software anymore — it’s infrastructure, security protocol, ethics, and innovation in one messy, fast-moving package.

Final Word from The Peak View Stories:

Innovation is easy. Trust is hard. And trust in fintech is built not just by how fast you move — but by how safe your users feel while moving with you.

Want more brutally honest takes on tech, money, and everything in between? Stay Tuned with The Peak View Stories — we read the fine print so you don’t have to.

Disclaimer: This article is based on real expert insights, opinions, and current best practices in the fintech industry. While we have tried to explain it in a way that doesn’t bore you to death, this is not legal, financial, or security advice. Please consult your CISO, lawyer, compliance officer, or at least someone who’s not writing fintech jokes online — before making decisions that involve money, laws, or data breaches.